Let’s examine what a cap rate is and how it allows investors to evaluate their rate of return. There are many ways to value real estate. It consists of appraising the land and building, comparing comparable properties, or calculating the value based on the rents being generated.

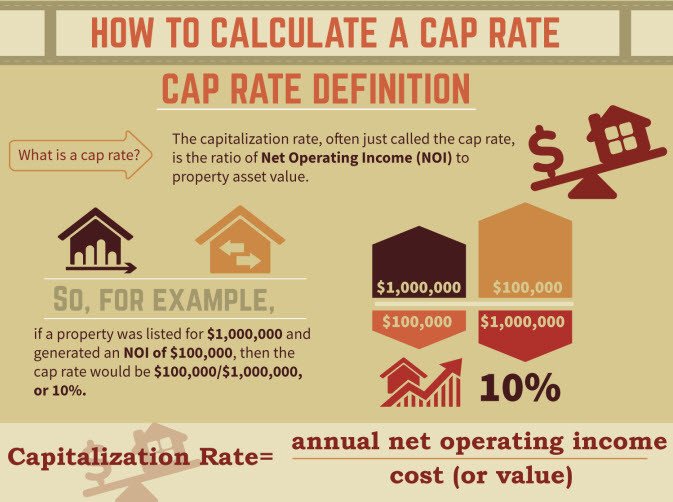

The later method is where the capitalization rate (or “cap rate”) comes into play. The cap rate (expressed as the ratio of the property’s net income to its purchase price) allows investors to compare properties by evaluating a rate of return on the investment made in the property. By examining the actual income (or rent) that the property generates and then deducting operating expenses (not including debt costs), the investor arrives at a property-level net operating income (or NOI). Once you determine the NOI, you simply divide that by the cost of the property or the price you are buying or selling the subject building for.

Calculating Cap Rate

While this method of valuation may appear simple, the use of the tool can be extremely valuable. Also, it’s important to mention that a Cap Rate does not show the full picture of the investment. It’s a only a snapshot of the first year’s returns and should not be treated as the only factor to consider. In general, a lower cap rate indicates there is less risk associated with the investment (due to a stronger tenant, such as a national chain or increased demand) and a higher cap rates can be associated with higher risk alternatives.

Real estate investors rely upon a variety of types information when negotiating for income producing properties – for instance, the desirability of the property’s current location and/or any prospective changes in the neighborhood are two common factors.

Looking for more information on cap rates? Click HERE to be forwarded to a Wiki How article with great simple diagrams – enjoy.

Investing In Commercial Real Estate?

Even after outlining all the information above, investing in CRE can still seem daunting. That’s why the Leveraged CRE Investment Team at Commercial Properties, Inc. is here to help you achieve your investment goals. Contact us at (480) 330-8897 or send us an email at request@leveragedcre.com.

Need help on how to get started investing in commercial real estate? We got you covered! We prepared a free e-book that will serve as your guide to achieve your long-term business goals or obtain that property you’ve always been dreaming of!

![]()

Phill Tomlinson is a commercial real estate broker with Commercial Properties, Inc. (CPI) in Scottsdale, Arizona, and owner of the Leveraged CRE Investment Team specializing in investment sales and tenant/landlord representation in the Phoenix and Scottsdale submarkets. Phill applies over 21 years of experience in the Real Estate industry helping investors and owners maximize their returns.

Bookmark www.leveragedcre.com to learn more about the Commercial Real Estate market and keep informed of relevant real estate strategies designed to maximize your income property investment results. Connect and follow Phill on Social Media at sm.leveragedcre.com/smplatform. #LeveragedCRE